How Evershine serve clients when clients using their own ERP in Thailand?

Assist your company’s ERP system for use in Thailand!

Help your company’s ERP system to be used in Thailand! Evershine provides Thailand regulatory compliance review, Thailand payroll operations services, manufacturing cost verification, and preparation of tax declarations in Thailand.

Email: bkk4ww@evershinecpa.com

Bangkok Evershine Services (Thailand) Co., Ltd. ,One of Evershine affiliates

Manager Paul, Speak in Thailandese and English

WeChat: Paul0864580532

ERP-TH-010

How Evershine serve clients on tax compliance review in Thailand?

Answer:

**Procedures:

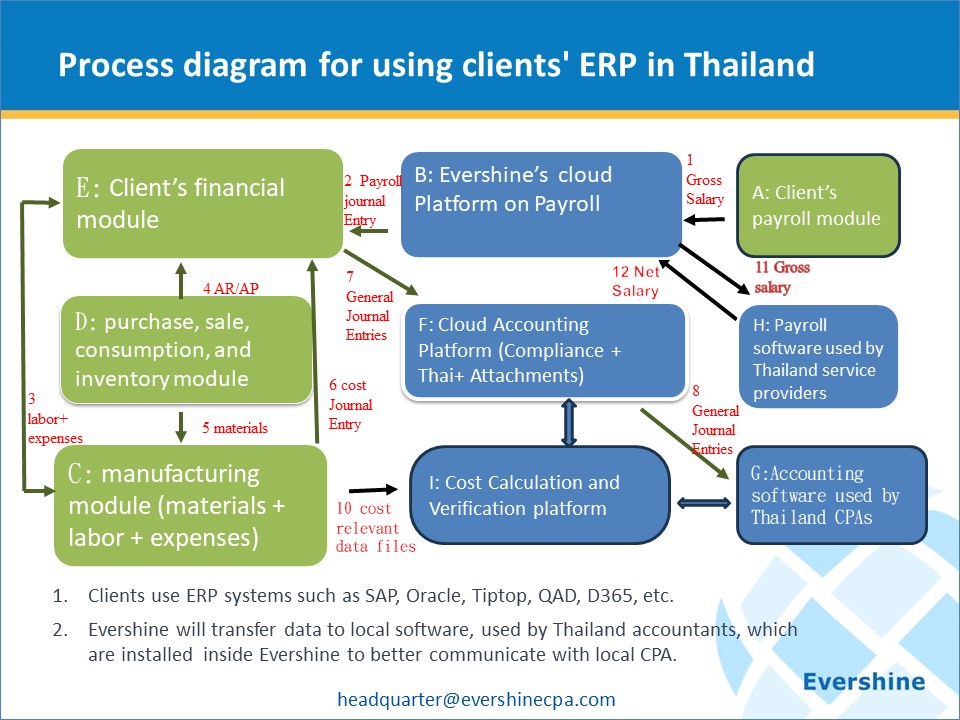

-E: clients will use ERP that parent company is familiar with.

-All transactions will be operated on clients’ ERP.

-After accounting entries being generated, they will be transferred to the F: Evershine cloud accounting platform.

**Service Focus:

-F: Evershine executing: compliance+Thai+attached documents.

-Before clients’ paying-out, must execute compliance review by Evershine in advance.

-Sales invoices must be issued after Evershine execute compliance review

-Collaboratively serve clients with Thailand local CPA firms affiliated with Evershine.

ERP-TH-020

How Evershine serve clients on Payroll processing & compliance in Thailand?

Answer:

**Procedures

-A: Receive relevant data from your ERP Payroll modue including: gross salary, basic salary, varible salary, leave, overtime, attendance and others.

-after receiving data files from E:ERP,transfer to B: Evershine Cloud Payroll Platform.

-Then, transfer to Evershine installed H: Thailand local payroll software and do gross to net salary calculation

– Then transfer fromH:Thailand local payroll to B: Evershine Clou Payroll Platform

-Transfer labor cost journal Entry to E: ERP Financial Module used by clients

**Service Focus

-Issue Payroll slip to each employee and accept query

-Generate labor cost entries according to clients’ instructions.

-Draft labor contract template and do labor compliance Review

-Serve clients collaboratively with Thailand local payroll service providers

ERP-TH-030

How Evershine serve clients to do cost-of-goods calculation when clients use their own ERP ?

Answer:

**Procedures

-Clients use their own ERP Manufacturing Module to do cost-of-goods calculation

-C: Manufactureing Cost = Materials+Direct Labor+Expenses)

-Materials Cost Data will be from D: clients’ ERP Selling, purchasing and Inventory modules

-Direct Labor Cost Data will be from B:Evershine Cloud Payroll platform

-Expenses data will be from E:Clients’ ERP Financial module。

**Service Focus

-if clients does not have local accountants to perform cost-of-goods calculation, Evershine will send our colleagues to do the services.

-Clients must provide 2 ERP user accounts for Evershine to use.

ERP-TH-040

How Evershine execute cost verification when clients using ther own ERP?

Answer:

**Procedures

•Obtain purchase book, sales book, inventory book and their attached documents from clients ERP D: purchase & selling &Inventory modules and C:manufacturing module

•I:Evershine will use its own costing system to do cost verification.

•if clients already entrusted Evershine to perform Cost Calculation, Evershine will simultaneously conduct Cost verification.

**Service Focus

•Before doing cost verification, will do reconciliation with relevant journal entries in advance.

ERP-TH-050

How Evershine help tax declaration preparation in Thailand when clients using their own ERP?

Answer:

**Procedures

-Transfer Journal entires from E: clients ERP Financial module to F: Evershine Cloud Accounting Platform.

-Evershine execute: Complinace review+ Thai+ attached documents.

-Transfer journal entries with attachment from F: Evershine Cloud Accounting Platform to G: regularly Thailand local accounting software implemented inside Evershine.

**Service Focus

-Evershine will be responsible for communicating with Thailand local accountants or tax CPA to prepare tax declaration documents for each country in Thailand.

-Evershine will use self-implemented G: regularly Thailand local accounting software to facilitate communication with Thailand local accountants or tax CPA in various countries.

How Evershine serve clients when clients using their own ERP in other countries?

Contact Us

Bangkok Evershine Services (Thailand) Co., Ltd. ,One of Evershine affiliates

Email: bkk4ww@evershinecpa.com

Manager Paul , Speak in Thailandese and English

WeChat: Paul0864580532

or

For how to exchange data files between your Finance Accounting System and Evershine Cloud Accounting Information System,

please send an email to HQ4bkk@evershinecpa.com

Dale Chen, Principal Partner/CPA in Taiwan+China+UK will be accountable to your case.

linkedin address:Dale Chen

Additional Information

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please send email to HQ4bkk@evershinecpa.com

More City and More Services please click Sitemap